Cau Vang Mien Bac: Connecting Stories from the North

Discover captivating news and insights from Northern Vietnam.

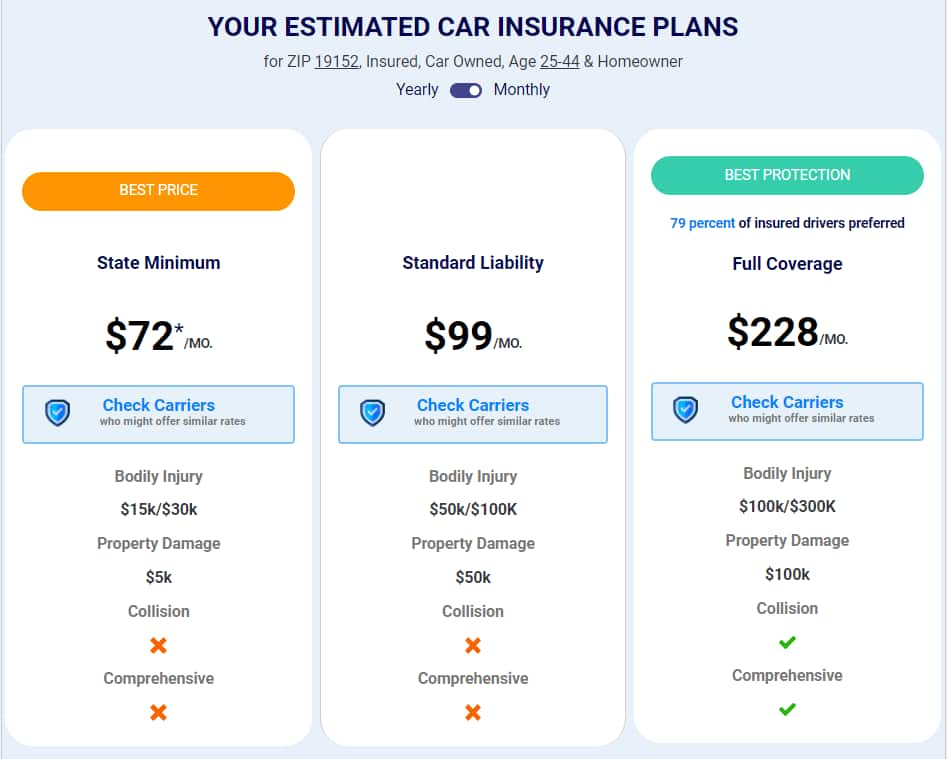

Cheap Insurance: Save Big Without the Hassle

Discover how to save big on insurance effortlessly! Uncover the best budget-friendly options and simplify your search today!

5 Tips to Find Affordable Insurance Without Compromising Coverage

Finding affordable insurance that doesn't compromise on coverage can be a daunting task. However, with the right strategies, you can secure a policy that meets your needs and fits your budget. Start by researching multiple providers to compare rates and coverage options. Utilize online comparison tools to get a clear picture of what different companies offer, and don’t hesitate to ask for quotes from local agents as well. This will allow you to spot any discrepancies and find the best deal.

Next, consider bundling insurance policies with the same provider. Many companies offer discounts for customers who purchase multiple types of coverage, such as combining auto and home insurance. Additionally, review your deductibles and coverage limits to ensure they align with your needs. You might find that adjusting these factors can lead to significant savings without sacrificing essential coverage. Lastly, don’t forget to take advantage of any discounts available, such as good student or safe driver discounts, which can further lower your premiums.

Is Cheap Insurance Worth It? Understanding the Pros and Cons

When considering whether cheap insurance is worth it, it’s essential to weigh the pros and cons. One of the significant advantages of cheap insurance is its affordability. For those on a tight budget, low premiums can provide a sense of financial relief, allowing policyholders to allocate their funds to other crucial areas. Additionally, cheap insurance often includes basic coverage options that can be sufficient for individuals who do not require extensive protection. However, it’s vital to understand that cheaper isn’t always better; the coverage limits may leave policyholders vulnerable to significant out-of-pocket expenses in the event of a claim.

On the flip side, there are notable drawbacks to choosing cheap insurance. Many low-cost policies may come with high deductibles, which means that while the initial premium is low, policyholders might find themselves paying more out of pocket when they need to file a claim. Furthermore, cheap insurance often means limited customer service and support; in times of need, dealing with an insurer that cuts corners can lead to frustration and inadequate assistance. Ultimately, while cheap insurance can provide immediate savings, potential customers should consider their specific needs and evaluate whether the trade-offs are worth the lower price point.

How to Get the Best Deals on Cheap Insurance: A Step-by-Step Guide

Finding affordable insurance doesn't have to be a daunting task. By following a structured approach, you can secure the best deals on cheap insurance. Start by researching different types of insurance that suit your needs, whether it’s auto, health, or home insurance. Create a list of potential providers and look for reviews to gauge their reliability and customer service. Once you have your list, compare quotes using online tools to identify which companies offer the most competitive pricing. Remember to factor in coverage limits and deductibles, as the cheapest option may not always provide adequate protection.

After narrowing down your options, consider bundling your policies with the same provider. Many insurance companies offer discounts for bundling, which can lead to significant savings. Additionally, don't hesitate to negotiate with insurers; they may be willing to adjust their offers or provide discounts for safe driving records or security features in your home. Lastly, regularly review your insurance policies. As your life circumstances change, your coverage needs may also evolve, presenting opportunities to find even better deals. By being proactive, you can ensure that you maintain the best coverage at the lowest cost.