Cau Vang Mien Bac: Connecting Stories from the North

Discover captivating news and insights from Northern Vietnam.

Renters Insurance: Because Your Sofa Deserves Protection Too

Protect your home and belongings! Discover why renters insurance is a smart investment for your sofa and peace of mind. Click to learn more!

Why Every Renter Needs Insurance: Protecting Your Belongings from the Unexpected

In today's unpredictable world, having renter's insurance is not just a smart choice; it's a necessary safeguard for anyone who rents their home. Renter's insurance provides financial protection against unexpected events such as theft, fire, or natural disasters. Many renters underestimate the value of their belongings, but a quick inventory can reveal thousands of dollars in personal items that would be difficult to replace. By securing a policy, renters can ensure they won’t bear the burden of these costs alone, giving them peace of mind in case the unforeseen occurs.

Moreover, renter's insurance isn't just about protecting personal property; it also covers liability in case someone gets injured in your rented space. This aspect of coverage is crucial, as it can save you from potentially devastating financial consequences if someone files a lawsuit against you. Investing in renter's insurance is an affordable way to shield yourself from the financial risks associated with renting, allowing you to enjoy your living space without constant worry about what could go wrong.

Understanding the Benefits of Renters Insurance: More Than Just a Safety Net

Renters insurance is often misunderstood, perceived simply as a safety net for unforeseen events. However, its benefits extend far beyond mere protection against theft or damage. For instance, it typically covers personal property, liability in case of accidents, and additional living expenses if the rented home becomes uninhabitable. This can provide peace of mind knowing that, should the unexpected occur, your belongings are safeguarded and you won’t face financial devastation.

Moreover, many landlords require tenants to obtain renters insurance, underscoring its importance in the rental process. A policy not only protects your assets but also fosters a sense of responsibility towards your living situation. Additionally, some providers offer bundled insurance options, often leading to discounts on auto or life insurance when combined with your renters policy. Overall, understanding these various facets of renters insurance can equip renters with better financial strategies and greater confidence in their housing choices.

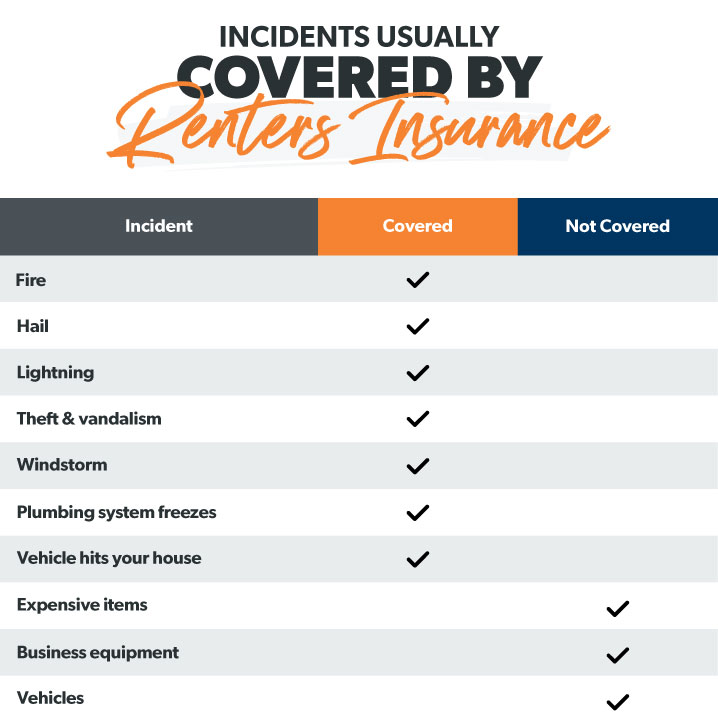

What Does Renters Insurance Cover? Unpacking the Policy for Your Peace of Mind

Renters insurance is designed to protect tenants from various unforeseen events that may cause loss or damage to their personal belongings. Typically, a standard policy covers personal property loss due to hazards like fire, theft, vandalism, and certain natural disasters. For instance, if your apartment suffers water damage from a burst pipe, your renters insurance can help cover the cost of replacing damaged furniture and electronics. Additionally, it often includes liability coverage, which safeguards tenants against lawsuits for injury or property damage occurring within their rental unit.

It's essential to understand that renters insurance doesn’t cover structural damages to the building itself; that falls under the landlord's insurance. However, many policies may offer coverage for additional living expenses if you are temporarily displaced from your home due to a covered loss. This ensures that you can continue to meet your day-to-day needs during the recovery period. By unpacking your renters insurance policy, you can gain peace of mind knowing that you are financially protected against life's uncertainties.