Cau Vang Mien Bac: Connecting Stories from the North

Discover captivating news and insights from Northern Vietnam.

Dollars in Your Pocket: Why Digital Wallet Integrations Are the New Frontier

Unlock the future of finance! Discover why digital wallet integrations are revolutionizing how we handle money today.

Exploring the Benefits of Digital Wallet Integrations: How They Enhance Your Financial Experience

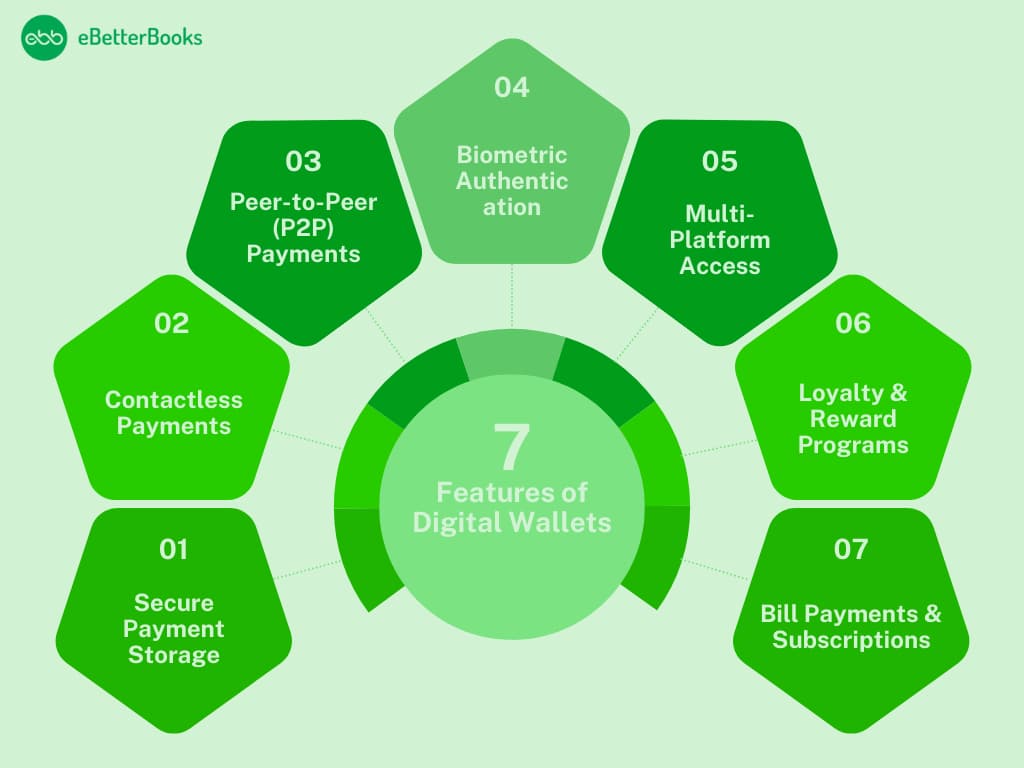

In today's fast-paced digital landscape, digital wallet integrations have emerged as a transformative force in financial transactions, enhancing consumer convenience and security. These integrations allow users to seamlessly connect their bank accounts, credit cards, and loyalty programs within a single platform, making it easier to manage finances efficiently. With features like encryption and two-factor authentication, users can enjoy the peace of mind that comes with secure transactions, reducing the risk of fraud. As more businesses adopt these technologies, the overall shopping experience becomes smoother and more intuitive, encouraging repeat engagement.

Moreover, the ability to integrate a variety of payment methods through digital wallets fosters financial inclusion by enabling users from different backgrounds to participate in the online economy. Many platforms offer options for cryptocurrencies, which can diversify payment choices and attract tech-savvy individuals. Additionally, businesses that implement these integrations often report increased sales and customer satisfaction, as they cater to a wider audience and provide a modern shopping experience. Overall, embracing digital wallet integrations not only streamlines payment processes but also contributes to a more robust financial ecosystem.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, competing to complete objectives or eliminate opposing teams. For those interested in enhancing their gaming experience, you can check out the betpanda promo code for potential bonuses. The game continues to evolve, attracting a dedicated player base and hosting numerous esports tournaments worldwide.

Are Digital Wallets the Future of Transactions? Understanding Their Role in Modern Finance

In recent years, digital wallets have gained significant traction in the world of finance, revolutionizing the way we conduct transactions. With the rise of mobile technology and the increased reliance on online shopping, more consumers are turning to digital payment solutions for their convenience and security. These wallets, which store payment information securely, allow users to make purchases easily with just a few taps on their smartphones. Some of the most popular digital wallet platforms, such as PayPal, Apple Pay, and Google Wallet, are not only enhancing the shopping experience but also playing a critical role in the transition towards a cashless society.

The benefits of adopting digital wallets extend beyond mere convenience. They provide enhanced security features, such as encryption and biometric authentication, which protect users from fraud and unauthorized transactions. Additionally, many digital wallets offer rewards programs and cashback incentives, encouraging users to adopt these innovative payment methods. As businesses and retailers increasingly embrace digital payment systems, we can anticipate a shift in consumer behavior, leading to further growth in this sector. Ultimately, the question remains: are digital wallets the future of transactions? With their growing popularity and the ongoing advancements in technology, it seems likely that they will continue to play a crucial role in modern finance.

Step-by-Step Guide to Integrating Digital Wallets into Your Business Model

Integrating digital wallets into your business model can significantly enhance customer experience and streamline payment processes. To begin with, analyze your target audience to determine which digital wallets they prefer. Next, choose the right digital wallet platforms that align with your business needs and customer preferences. Popular options include PayPal, Apple Pay, and Google Wallet, each offering unique features that cater to different markets. Once you've selected a wallet, partner with a payment processor that supports these platforms, ensuring your transactions are secure and efficient.

After selecting your platforms and payment processor, the next step is to integrate the digital wallets into your checkout process. This usually involves updating your website's payment gateway or utilizing plugins for your e-commerce software. Make sure to test the integration thoroughly to avoid any issues that could frustrate customers. Finally, promote your new payment options through email newsletters and social media, highlighting the convenience they offer. By following this step-by-step guide, you can seamlessly incorporate digital wallets into your business model and cater to the modern consumer's needs.