Cau Vang Mien Bac: Connecting Stories from the North

Discover captivating news and insights from Northern Vietnam.

From Coins to Codes: Evolving with Digital Wallet Integrations

Explore the revolution from physical coins to digital wallets! Discover how integrations reshape transactions and boost your financial game.

Understanding Digital Wallets: A Guide to the Future of Transactions

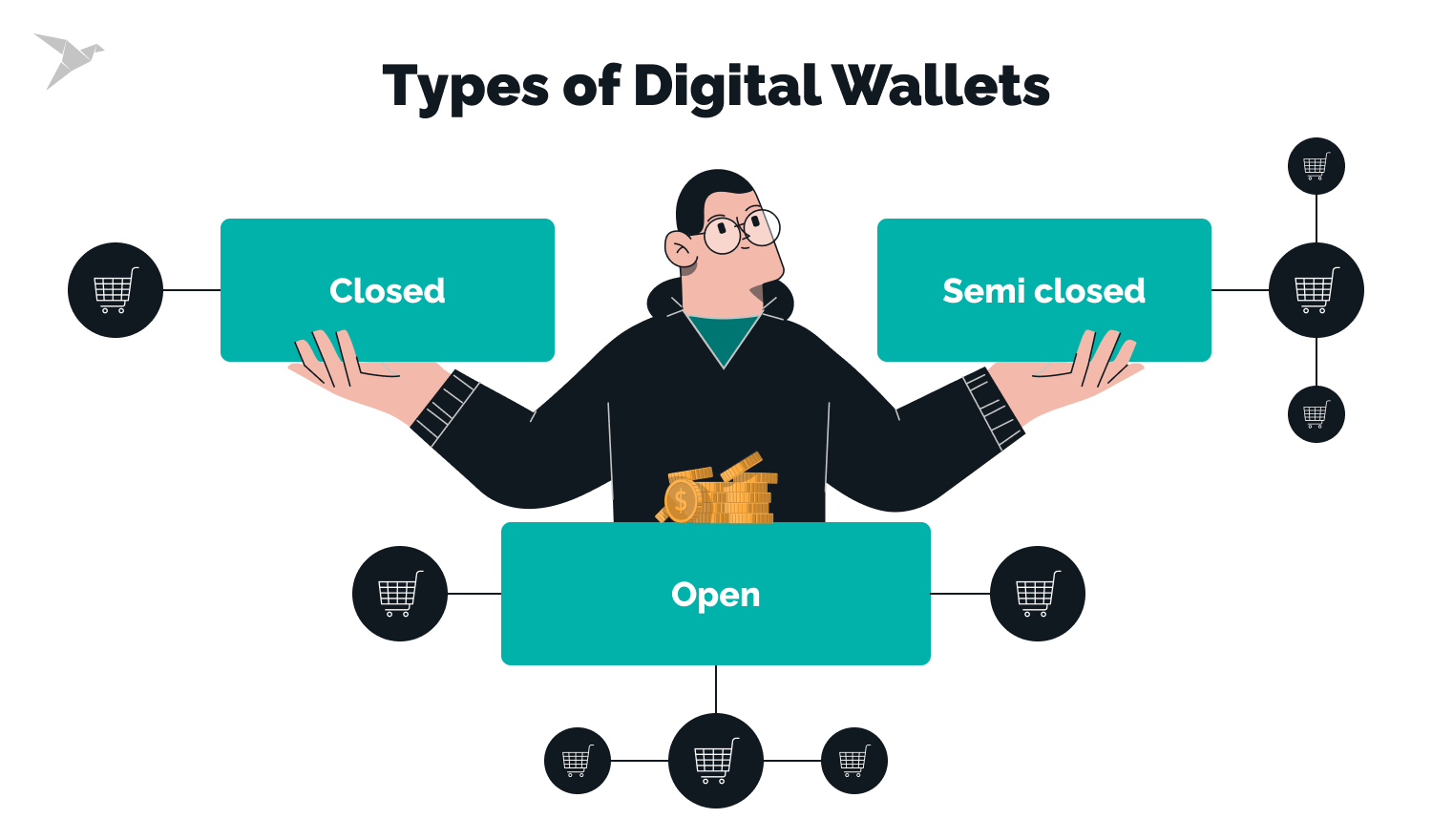

In an increasingly digital world, digital wallets are becoming a key player in how we conduct transactions. These secure apps allow users to store payment information, loyalty cards, and even identification directly on their smartphones. With the rise of contactless payments and the need for quick, hassle-free transactions, understanding digital wallets is essential for consumers and businesses alike. Digital wallets not only improve convenience but also enhance security through encryption and biometric authentication, making them a safe alternative to traditional wallets.

Several types of digital wallets exist, each serving different needs. For instance, mobile payment solutions like Apple Pay and Google Wallet enable users to pay with a tap of their smartphone. Meanwhile, other platforms like PayPal and Venmo facilitate online purchases and peer-to-peer transactions. As consumers continue to embrace this technology, businesses must adapt to accept digital wallets as part of their payment methods. Understanding the benefits and functionalities of these wallets can help you navigate the future of transactions confidently.

Counter-Strike is a highly competitive first-person shooter that has gained immense popularity since its release. Players can engage in tactical gameplay, choosing between various game modes and maps. If you're looking to enhance your gaming experience, you can check out the betpanda promo code for exclusive offers!

The Benefits of Integrating Digital Wallets into Your Payment System

In today's fast-paced digital landscape, integrating digital wallets into your payment system offers a myriad of benefits that can enhance customer experience and streamline operations. Digital wallets allow consumers to store multiple payment methods in one secure location, making transactions quicker and more convenient. This not only reduces the time spent at checkout but also minimizes the chances of cart abandonment, as customers are less likely to hesitate during the payment process. Additionally, digital wallets often come with robust security features, such as tokenization and biometric authentication, which can help build consumer trust and protect sensitive information.

Moreover, by adopting digital wallets, businesses can tap into valuable customer insights. Tracking payment data from digital wallets can reveal spending habits and preferences, enabling companies to tailor their marketing strategies and improve customer engagement. Furthermore, integrating digital wallets can also facilitate international transactions, removing the barriers caused by currency conversion and providing a seamless shopping experience for global customers. Overall, the inclusion of digital wallets not only modernizes your payment system but also positions your business to better meet the expectations of today’s tech-savvy consumers.

How to Choose the Right Digital Wallet for Your Business Needs

Choosing the right digital wallet for your business is crucial for enhancing customer experience and streamlining financial transactions. Start by assessing your business needs. Consider factors such as transaction volume, the payment methods you wish to accept, and whether you require features like invoicing or expense tracking. It’s important to integrate a digital wallet that can easily interface with your existing systems, whether you operate an e-commerce site or a physical retail location. Popular options like PayPal, Square, and Stripe offer a range of services, so make sure to compare their features, fees, and user interfaces before making a decision.

Security should be a top priority when selecting a digital wallet. Look for options that provide advanced encryption, fraud protection, and compliance with industry standards. Additionally, consider each wallet's ease of use for both your staff and customers. Collect feedback from your team and clientele to understand their preferences, as user experience can significantly impact your sales. By meticulously evaluating these aspects, you can select a digital wallet that not only meets your business requirements but also cultivates customer trust and satisfaction.